Klk Revenue

Kuala lumpur kepong berhad klk is a company incorporated in malaysia and listed on the main market of bursa malaysia securities berhad with a market capitalisation of approximately rm24931 billion at the end of september 2019. Klk marketing has an estimated revenue of 1m and an estimate of less 10 employees.

Klk Recognised In Forbes Asia S 200 Best Over A Billion 2019

Klk has an estimated 34 employees and an estimated annual revenue of.

Klk revenue. Get the detailed quarterlyannual income statement for klk klkkkl. Check out klk productionss profile on owler the worlds largest community based business insights platform. Klk oleo has an estimated revenue of 1m and an e.

Results klks earnings of r463 million for 2018 show a decrease of 76 compared to the previous financial year. Klk also finds it important to provide support and input in this area by means of its organisational structures in order to contribute to the search for solutions. Klk oleo has 9 followers on owler.

2445 is a malaysian multi national companythe core business of the group is plantation oil palm and rubber. Stock analysis for kuala lumpur kepong bhd klkbursa malays including stock price stock chart company news key statistics fundamentals and company profile. However the results are still satisfactory if the current.

Kuala lumpur kepong berhad klk myx. Klk oleo is a private company. Klk has 10 employees and is ranked 1st among its top 10 competitors.

Klk marketing is a private company. Klks top 1 competitors are klks revenue is the ranked 1st among its top 10 competitors. Find out the revenue expenses and profit or loss over the last fiscal year.

The top 10 competitors average 10m. Klk provides compliance accounting and taxation consulting services to real estate technology and manufacturing sectorsklks headquarters is located in tucson arizona usa 85701. The company has plantations that cover more than 250000 hectares in malaysia peninsular and sabah and indonesia belitung sumatra and kalimantansince the 1990s the company has diversified its business activities such as resource based.

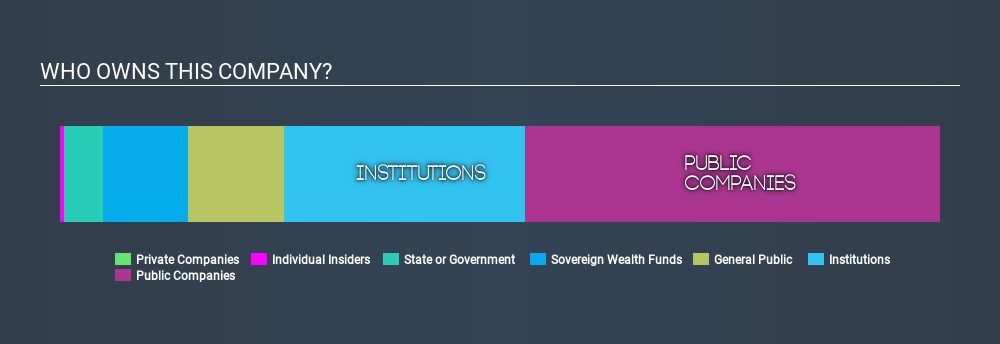

What Kind Of Shareholder Owns Most Kuala Lumpur Kepong Berhad

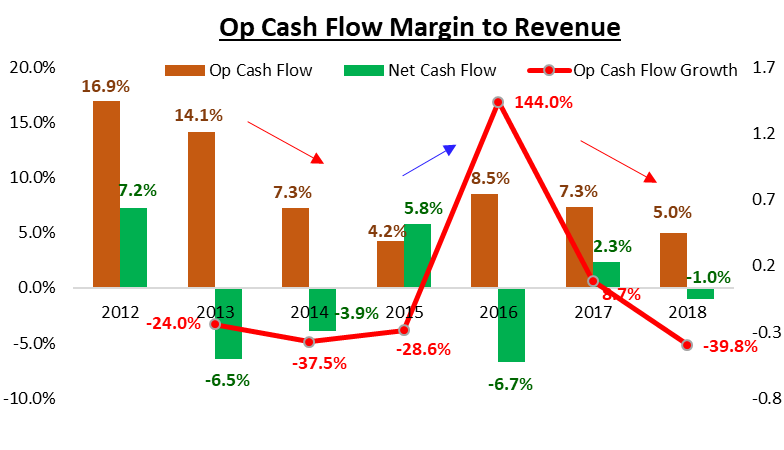

Kuala Lumpur Kepong Is It The Right Time To Take Off Profits

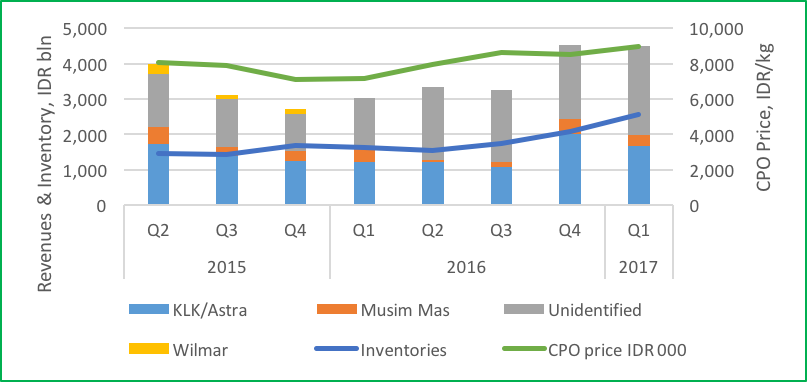

2017 Indonesian Palm Oil Sector Benchmark Revenue At Risk

Klk Q4 Profit Jumps 37 The Star Online

How Do Vertical Fiscal Transfers Affect The Revenue Raising

Klk Posts Higher 2q Profit On Lower Taxation

Highest Return On Equity Over Three Years Plantation Kuala

Comments On Kuala Lumpur Kepong Berhad 2445

Klk 3q Net Profit Rises 26 On Better Showing By Manufacturing